Reported documents show that HP’s Autonomy write down was not caused by fraud

When Meg Whitman wrote off nearly $9 billion of the value of HP in November 2012, she alleged that more than $5 billion of that write down was a result of fraud at Autonomy before it was acquired by HP. We have now seen conclusive proof that this allegation is false.

The Financial Times has published excerpts from an internal HP document, known as a “rebasing exercise”, that details how the $5 billion Autonomy write down was calculated; the FT states that this document has been verified by HP. The document shows the write down was due to HP’s changes in accounting policy and it’s own business decisions, not fraud.

“In response to the findings of the Rebasing Exercise, PWC’s investigation, and Autonomy’s performance, HP created a new three year budget in order to develop a revised operational plan for the Autonomy business unit to execute. The Company also created a ten year forecast for Autonomy that would project cash flows in order to inform HP’s goodwill impairment analysis.” (DRC report page 45, filed in July 2014)

In simple terms, HP’s own paperwork shows that all Autonomy deals were recorded and accounted for. There are contracts and revenue entries. There is no missing money. The only differences are over interpretation of accounting standards.

We have been asking to see these documents for over two years since the original allegations were made, but HP has always withheld them. Now we have seen the original material, we believe that HP’s own calculations show that HP has made false and misleading public statements to the market about how and why it wrote down Autonomy and what really happened. We will be passing a copy of this document and other information to the relevant regulatory authorities for their review.

Meg Whitman must now withdraw her allegations against the former management team of Autonomy. If she has any decency she will then make a formal apology and resign.

HP’s Rebasing Exercise

The rebasing calculations were undertaken by HP to bring the accounts of Autonomy, reported under IFRS (International Financial Reporting Standards, the system commonly used in the UK), into line with the US GAAP system (the Generally Accepted Accounting Principles used in the United States), after it was acquired.

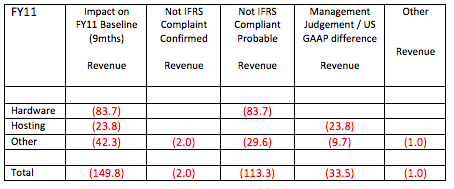

The FT reports that, through this rebasing exercise, HP concluded that under a US accounting jurisdiction certain revenues could be reported in different periods. HP subsequently removed this revenue from Autonomy’s 2010 and 2011 accounts, and simply moved it to be recognized in later periods. In the document, HP stipulates that these decisions were taken on the basis of management judgement and interpretation of IFRS standards. Audit evidence shows that the revenue HP removed was from legitimate contracts with large multinational customers that had been fully audited and approved. However, in November 2012 HP alleged to the market that this revenue did not exist or had been misrepresented.

This is a summary of the document that the FT has reported and which shows HP’s decision-making process for removing bona fide revenue from Autonomy’s accounts – and none of it was fraud. It also shows no money was missing. The run rate revenue was at the time around a billion dollars.

When you look at these adjustments, the two biggest categories are hardware and hosted deals. If we consider each of these in turn, firstly hardware.

It is hard to know on what accounting basis one does not count this as revenue: it was sold and fully paid for by customers and there is nothing wrong in selling hardware. In fact, HP has now confirmed was well aware of Autonomy’s hardware sales long before the “whistleblower” came forward.

HP misrepresented its own knowledge regarding Autonomy’s hardware sales to the market. Over time its position has evolved from the original statements in November 2012 when HP claimed it did not know about the mischaracterization of revenue from “negative-margin, low-end hardware sales” until a “whistleblower” came forward in June 2012 all the way to today’s stance where, in court filings in September HP stated that, although it knew Autonomy sold hardware prior to the acquisition, Autonomy management had indicated that such sales were “either ‘appliance sales’ or ‘strategic sales’ designed to further purchases of Autonomy software”.

The next largest category of adjustments are hosted deals. They have taken out all of these deals, including from companies such as BP, JPMorgan Chase, Deutsche Bank, and so on. These are noted in the adjustment column as being “US management judgement” ie they are not being removed for fraud, but for different accounting policies.

HP made these aggressive revenue adjustments even though HP was aware, prior to the acquisition, that Autonomy sold hybrid hosted deals and understood the associated accounting.

- The accounting of these deals was covered in Autonomy’s annual report, audit packs, analyst calls and reports.

- KPMG HP’s due diligence advisor in August 2011 asked many questions on accounting for hosted deals showing it understood the approach.

- HP reviewed numerous Autonomy contracts for hybrid hosted sales, which articulate the actual products sold, in advance of the acquisition;

- Internal HP emails, many of which involve the highest levels of HP management, evidence HP’s own knowledge and acceptance of Autonomy’s accounting policy for such deals

- Documents make clear that when HP abandoned this exercise in 2012, it did on account of its own internal accounting policy and strategic objectives

The document shows that, for example, revenue from Autonomy’s hosted business was removed due to “management judgment / US Gaap difference”, not fraud.

Timing

Critically, the rebasing exercise in question was completed a month after HP made its allegations about Autonomy, which appears to suggest that the allegations were made before the facts had actually been investigated.

Moreover, HP was aware of the transactions addressed in the document before completing the acquisition of Autonomy, and did not raise any concerns. The column headings in the document purely address whether or not valid transactions were reported under IFRS, or could be open to interpretation. Where HP considered there was a possibility to classify revenue differently, they did so. This shows that HP arbitrarily adjusted whole categories of deals it already knew about and did not question before it made the acquisition.

HP’s shareholders deserve an honest explanation and an end to this charade.