Court Filed Document Raises Questions Over HP’s Statements

Introduction

In November 2012, HP accused the former management of Autonomy of accounting misrepresentations and wrote off $8.8 billion of the value of its acquisition of the company. Since then, HP has consistently avoided providing any specific details in support of its allegations. On Friday, 5th September 2014, HP filed paperwork to a US court that sheds a lot of light on what went on.

The document submitted by HP’s lawyers, is the Independent Committee’s Resolution Regarding Shareholder Derivative Claims and Demands, commissioned by Meg Whitman and the Board of HP. The filing of this report went unnoticed as HP buried it in a mass of documents supplemental to their original filing, which they used to divert press attention with an out-of-context email.

This report, together with some accompanying evidence released today by the former management of Autonomy, reveals the truth about the circumstances of the purchase. It also provides evidence that HP claims that it was unaware that Autonomy derived part of its revenue from the sale of hardware are no longer supportable.

We can also prove today that HP included those hardware sales in its own valuation of Autonomy.

In addition, the document reveals that:

- HP’s aggressive assumptions led it to believe it could find some $7.4 billion in synergies

- KPMG found no “material issues” with Autonomy’s accounting

- HP had Autonomy on its acquisition target list from 2006

- HP conducted a speedy but thorough due diligence process because they were afraid of competitive bids

- The HP “whistleblower” was not knowledgeable about how Autonomy did its accounting in the UK, or the IFRS accounting rules Autonomy reported under

- HP’s CFO and General Counsel opposed the acquisition of Autonomy

The Real Reason for the Write-Down

The new information received makes clear the real reason for the write down was because of the unprecedented level of synergies assumed in the deal by HP.

The report filed on 5 September 2014, reveals for the first time that HP built into its valuation of Autonomy “$7.4 billion in revenue synergies” (p33). At the time of the purchase, Autonomy had a stand-alone market value of approximately $6 billion.

The filing goes on to reveal that $5.3 billion of the “originally projected synergies” (p45) of $7.4 billion, was written off. This accounts for the majority of the write down. A further $3.6 billion write down was described by HP as being “linked to the recent trading value of HP stock and headwinds against anticipated synergies and marketplace performance” (20 November 2012 HP press release). Nothing, therefore, to do with Autonomy. The write down is quantified at $8.9 billion purely from synergy loss and and a decline in stock value. This is a reversal of the original statements in November 2012 that the “majority” of the write down (more than $5 billion) was due to “accounting misrepresentations”. The total write down on the day was $8.8 billion of the purchase price of $11 billion.

Not surprisingly, the new information also reveals that “E&Y could not “audit” quantification of Autonomy’s accounting errors” (p47).

The filing informs us that CFO Cathy Lesjak foretold this when she opposed the deal “HP’s history of not executing on its major acquisitions” (p34).

Autonomy’s management cannot be held responsible for HP’s excessive forecasting of synergies. The write off is due to HP’s own recklessness and not due to any accounting improprieties.

The synergies were predicated on taking sales people from HP to expand the Autonomy salesforce, taking services people from HP to increase Autonomy services, and closer integration between Autonomy products and the hardware divisions.[1] The new information shines further light on the sources of the synergies: “HP’s footprint could be leveraged from a sales, customer, geographical and technology perspective to maximize revenue synergies” (p37).

CFO opposed acquisition of Autonomy

The report reveals CFO Cathy Lesjak’s opposition to the acquisition:

“The Board’s non-management directors met on August 17, 2011, principally to consider in executive session the opposition/concerns expressed at the August 16 meeting by HP’s CFO Lesjak that, while the strategic vision underlying the Autonomy acquisition should be respected and embraced, she opposed the acquisition of Autonomy at that time because (i) the size of the premium would concern shareholders, (ii) HP’s bankers had underestimated the impact of the acquisition on HP’s stock price, as well as the likely negative shareholder sentiment and that (iii) HP’s history of not executing on its major acquisitions did not counsel proceeding with the acquisition at that time. The General Counsel agreed.” (p.34)

Hardware Sales

In its original allegations of November 20, 2012, Hewlett-Packard expressed surprise that Autonomy sold hardware, accused the company of accounting for it wrongfully and of deceiving its auditors on this matter. HP claimed this amounted to much of the $150-200 million of sales over two years it claimed was “mischaracterized” by Autonomy. Once HP started down this path even as information has come to light showing it was wrong, and HP itself had knowledge that it was wrong, but it has been forced to continue.

When HP accused the former management of Autonomy of accounting irregularities, it blamed the majority of these on “hardware booked as software”, and claimed that it was unaware that Autonomy was anything other than a software-only company until a “whistleblower” came forward to point it out.

However, what this report now proves categorically, is that HP knew about Autonomy’s hardware sales well over a year before they made their public accusation.

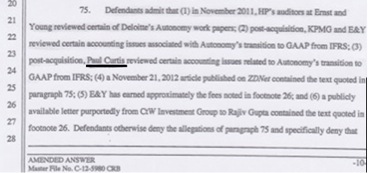

In public class action filings, HP have admitted that senior HP accounting staff, KPMG and E&Y reviewed a number of documents in November 2011 without recorded surprise or alarm. The new information reveals the following:

- “E&Y’s November 2 – 4 2011 review of Deloitte work papers ….identified Autonomy’s hardware revenue, which E&Y reported to HP” (p40)

- “In the course of E&Y’s exposure to Deloitte’s work papers for the purpose of establishing an opening balance sheet…E&Y noted that Autonomy sold material quantities of hardware. E&Y reported its observation to HP management”. (p57)

- “KPMG’s post-Acquisition identification of $41 million in pre-Acquisition “Pass – through” hardware sales was appropriately conveyed by both KPMG and HP management to Autonomy management for explanation……Autonomy’s management ultimately responded that Autonomy procured hardware as well as software for certain strategic accounts” (p39)

- “In its post-closing balance sheet review, KPMG found evidence of hardware sales and made inquiries about them” (p56)

Documents show that senior officers of Hewlett-Packard were, in fact, well aware of Autonomy’s hardware sales, and the accounting of these, from day one almost a year before the announcement of its write down of Autonomy. These statements, and others made on that day, are untrue, as is shown by the documents posted below.

To recap, on 20th November 2012, senior management of Hewlett-Packard made a series of allegations that these documents show to be misleading. John Schultz, HP General Counsel, said Autonomy, “resold desktop computers … and recorded those sales so they appeared to be software revenue,”[1] that there was “active concealment”[2] and that there wasn’t “a set of well-maintained books … critical documents were missing from the obvious places”[3].

Meg Whitman said that HP, “relied on audited financials, audited by Deloitte, not brand X accounting firm, but Deloitte and, by the way, during our very extensive due diligence process, we hired KPMG to audit Deloitte, and neither of them saw what we now see after someone came forward to point us in the right direction.”[4] Speaking to reporters that same day, CFO Cathy Lesjak said the “hardware sales were frequently reported as licenses.”[5] These allegations were repeated in last Friday’s filing.[6]

In fact, Autonomy was fully open and transparent with its auditors, and all financial documents, including audit committee reports were kept at the company’s headquarters in Cambridge. The most important financial documents in the Company are the quarterly financial audit review packs. HP and its advisors had access to these from day one.

Hardware in Audit Packs

The first three documents are examples from Deloitte’s quarterly presentations to Autonomy’s audit committee – the very same working papers that were reviewed by E&Y and HP – from when Autonomy was listed on the London Stock Exchange (of 10 such quarterly presentations that took place during the period in question by Hewlett-Packard’s allegations). In these, Deloitte discussed Autonomy’s hardware sales, how they were accounted for (including accounting for some of the discount as a marketing expense), and discussed the disclosure of this information to the market. The documents show that the auditors were completely aware of the hardware sales, which were in no way concealed or booked as software and were referred to as “hardware”. These audit packs were the most concise summary of each quarter’s accounting and were available to Hewlett Packard from the day they acquired the company (being a whole year before the announcement of the write-down).

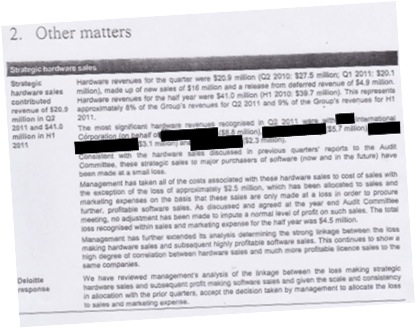

Deloitte’s report to the Autonomy Audit Committee Q1 2011 clearly showing hardware sales as hardware, their amount, the fact that they are taken at a loss and the associated accounting

Deloitte’s report to the Autonomy Audit Committee Q2 2011 clearly showing hardware sales as hardware, their amount, the fact that they are taken at a loss and the associated accounting

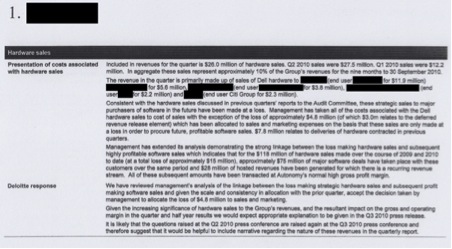

Deloitte’s report to the Autonomy Audit Committee Q2 2010

Extract from Hewlett Packard court filing in California 5 June 2014. Paul Curtis was HP’s head of worldwide revenue recognition who scrutinised Autonomy’s accounts without raising any issues.

Hardware booked as software?

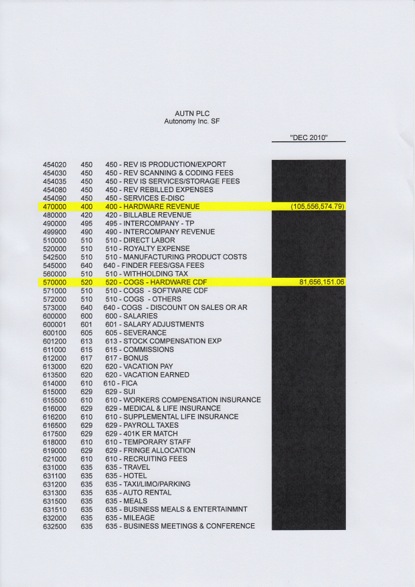

On November 20th 2012, John Schultz made the statement that Autonomy had “booked hardware as software revenue.” While this is clearly not the case from the Deloitte audit committee reports, it is also not true when one looks at the ‘Trial Balance’ (TB) or formal ledgers of the company recording all items bought and sold. In the excerpts from the Trial Balances below, you can see the entry line 470000 “hardware revenue” and the corresponding revenue. Line 570000 shows the cost of goods of hardware. Thus, it is clear that hardware is being booked as hardware, and not software and it shows the amounts involved.

Ledger entry October 31, 2011 showing hardware bought and sold including cost of goods

Emails show senior HP accounting staff using this Trial Balance for many operations from November 2011 onwards. It was obvious to these staff members that Autonomy sold these amounts of hardware. Furthermore, these trial balances are also shown in a number of emails being used by KPMG taking on accounting work on behalf of HP.

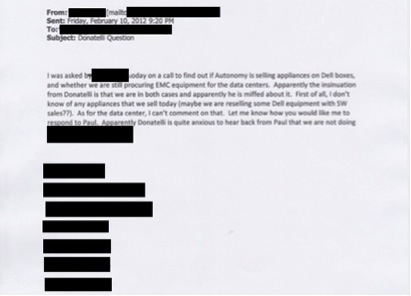

Autonomy’s hardware sales were also well known amongst the leadership team of HP. Dave Donatelli, at the time head of ESSN (Enterprise Software and Server Networking) and a member of the Executive Committee, was well aware of the resale of EMC and Dell hardware well before any whistleblower came forward and 10 months before the write down in November 2012.

Email from Autonomy employee to HP employee showing Dave Donatelli, head of ESSN, had awareness of Autonomy hardware transactions.

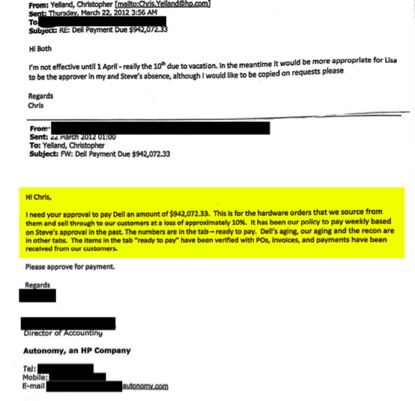

It was also clearly known that Autonomy sometimes sold hardware to its customers at a loss for strategic reasons. Chris Yelland, who reported directly to Cathy Lesjak HP’s CFO, was one of the most senior accountants in HP’s software division. He sent an email on March 22, 2012 discussing payment to Dell for hardware explained as “hardware orders that we source from them and sell to our customers at a loss of 10%.”

Email exchange dated March 2012 among HP employees showing they discussed Autonomy hardware transactions. Chris Yelland was a senior HP finance employee who was transferred to Autonomy in April 2012.

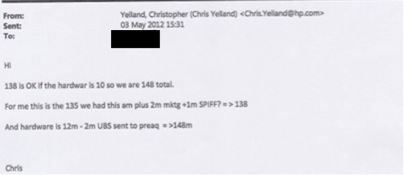

On 3rd May 2012, there is another email exchange between Mr Yelland and an employee that also makes explicit reference to hardware.

Email dated early May 2012 showing a senior HP accountant knew about, and was happy with, Autonomy hardware transactions.

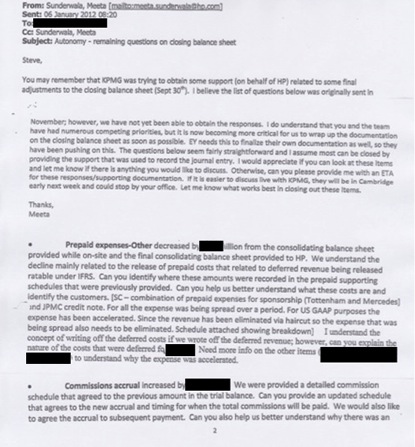

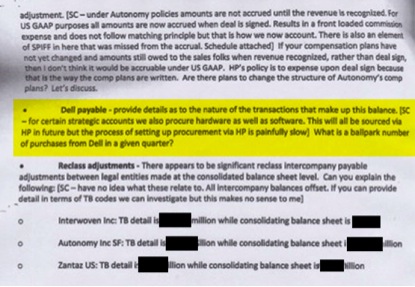

Similarly, an email dated January 6, 2012 from Meeta Sunderwala, a senior member of HP’s mergers and acquisitions accounting team, explicitly discusses Dell payables and explains that for many strategic accounts Autonomy procured hardware as well as software. There are many more such emails showing that senior HP staff were well aware of Autonomy’s hardware business, how it was accounted and booked long before the alleged whistleblower came forward.

Email dated January 2012 showing a senior HP accountant was fully aware of Autonomy’s hardware transactions.

In short, the above are just three examples from the many hundreds of documents showing that many senior HP staff and HP’s advisors knew that the statement made by John Schultz on 20th November 2012 expressing surprise at Autonomy’s hardware sales, at the fact that some of them were made at a loss, were untrue. They also show that these were not hidden from Autonomy’s auditors and it is also untrue to say that they were booked as software. These documents show that HP lied about its knowledge of hardware sales and the associated accounting. It was well aware of the facts at some of the most senior levels of the company well before the “whistleblower” on May 25, 2012.

Autonomy valuation by HP included hardware

HP has said that one of the reasons for the write down in the value of the company was that it did not realize that hardware was being sold. The report filed on 5th September, however, shows clearly that it was well aware of hardware sales and it also shows that the valuation of the company included hardware.

- “In the course of E&Y’s exposure to Deloitte’s work papers for the purpose of establishing an opening balance sheet…E&Y noted that Autonomy sold material quantities of hardware. E&Y reported its observation to HP management”. (p57)

- “The Autonomy purchase price allocation was prepared by Duff & Phelps. E&Y then audited that allocation were disclosed in HP’s FY 2011 Report on Form 10K” (p57). The 10K was signed by HP directors on December 14 2011.

What this shows is that the value of the company at $11 billion fully included hardware sales therefore it is clear that six months later these same hardware sales cannot be used to justify a change in the valuation.

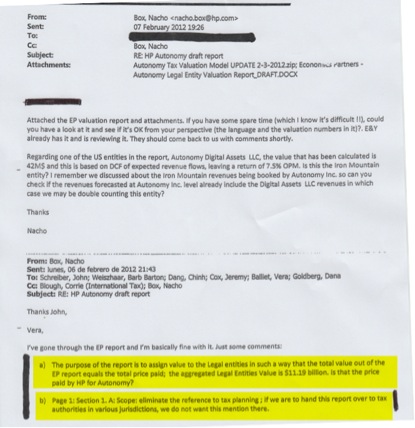

Economic Partners (EP) was a firm that HP employed to conduct a tax valuation of Autonomy. It included the hardware, and came out at $11.19 billion. This valuation was used for various statutory purposes, and was reviewed by HP and E&Y.

This email exchange from February 2012 shows that Economic Partners’ third-party valuation of Autonomy, which included the hardware, was used by HP with tax authorities.

This filing on September 5th also shows that HP’s basis for its valuation was built on discounted cashflow: “On September 13, 2011, Apotheker stated: “we have a pretty rigorous process inside HP that we follow for all of our acquisitions, which is a DCF-based model, and we try to take a very conservative view at this… we have and are running an extremely tight and very professional due diligence process…Autonomy is a publicly-traded company in the UK and they are, therefore, audited like any other FTSE company, and they’re being audited on very professional standards.” (p36).

From HP’s re-filed Autonomy accounts for 2010 we see that they are in agreement that there has been no change in Autonomy’s historic cash flows as a result of the allegations. The new information shows the that number which has been changed is HP’s estimate of future prospects for the company, not its past accounting. The change in future prospects is dominated by the inability to deliver the synergies and the loss of most of the significant talent in the business due to the mismanagement.

Anatomy of the Deal

Long-Standing Target

This report shows that HP had been considering an acquisition of Autonomy as early as 2006 (p29) and had considered it a “[target] to be aggressively pursued” (p29).

That they had not done so until 2011 was largely due to Autonomy’s value. It was Leo Apotheker who considered the acquisition of Autonomy to be “transformational opportunity” (p29), a “game-changer” that would be “financially accretive” for the company. HP’s bankers also recommended the acquisition on the basis that Autonomy was “a crucial offensive move toward [HP’s] strategic vision and that [HP] should pursue the acquisition expeditiously” (p30).

This belies HP’s suggestion that Autonomy’s management was desperate to offload the company.

Autonomy was not driving the sale to HP

In its September 5th filing, HP presented one email, dated 10 December 2010, out of 17.5 million emails without giving its context to imply that Autonomy was “in a financial plane crash” and thus a radical solution was to sell the business to HP.

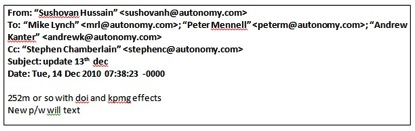

This is completely misleading as the emails around this date show, and which HP did not disclose. Autonomy, far from being in a financial meltdown was ahead of targets and, just two weeks later, delivered record results with operating profits of $376 million. The use of this email, out of context, by HP was dishonest in the extreme. Autonomy was not in financial free-fall, nor did it consider selling the company a necessity. Qatalyst Partners, the bank that handled the sales process, was not engaged by Autonomy until June 2011. The email below, just four days later from HP’s twisted version of events, shows that Autonomy’s forecast was on track to exceed analyst expectations for the quarter.

This email shows that Autonomy was forecasting revenue of $252 million on 14 December 2010, which was in excess of analyst expectations for Q4 2010, which were set at $241 million.

Fear of Competitive Bids

In July 2011, HP’s board granted its approval for the HP’s management to proceed with its due diligence process, which new information shows followed standard market procedures. The data, according to KPMG, “were comparable to those available in other acquisitions involving large UK public companies” (P56) and “UK due diligence experts confirmed “access to due diligence materials reflected standard UK market practices for acquisitions of FTSE 100 Companies” (P56). HP’s bankers had warned of “interloper interest” (p31), which were identified as “including IBM, Oracle, Google, EMC and SAP” (p31).

Deloitte

On 17 August, KPMG and HP held a “one-hour” call with Deloitte in which Autonomy’s auditor responded to a series of questions about “revenue recognition, instances of fraud, control weaknesses, significant issues communicated to Autonomy’s board, disagreements with management and unadjusted audit differences” (p32). This was the only conversation that took place with Deloitte in the due diligence process. KPMG considered there were “no material issues” as a result of this conversation, although they failed to update a draft report to the board that had been prepared on August 9. Just 24 hours after that call with Deloitte, HP publicly announced their intent to acquire Autonomy.

Announcement

Despite their thorough due diligence, when HP’s shareholders reacted negatively to the announcements HP made in its Q3 earnings, “HP asked certain of its advisors whether HP could back out of the deal” (p10 HP amended answer 5 June 2014 court filing).

Shortly after the acquisition, and in panic mode, HP fired Leo Apotheker and Shane Robison, architects of the deal. With nobody left to sponsor the integration, is it any wonder, then that Cathy Lesjak’s warning that HP “acquisitions did not meet performance expectations” were close to coming true?

The identity of the “whistleblower”

The document reveals that the “whistleblower” who met with HP’s management almost a year later, on 25th May 2012, was “a legacy Autonomy US official” (p2). All of Autonomy’s accounting books and accounting policies operated centrally in the UK office. We do not believe that Autonomy US had any qualified accountants employed at the time and certainly nobody with knowledge of IFRS.

Furthermore, we note from the document that the informant was commenting from a US GAAP perspective: “transaction involving Value Added Resellers that could pose questions under US Generally Accepted Accounting Principles” (p2). Autonomy reported under a different set of rules: International Financial Reporting Standards.

Conclusion

HP has consistently stated that Autonomy management sold hardware that HP did not know about and booked it as software. And that this was so well hidden that it was not known until the whistle blower came forward.

The above documents do not reflect these statements. Not only was the hardware clearly disclosed to the auditors, but the audit packs and related trial balance ledgers showing hardware were used by a large number of KPMG, HP E&Y accounting staff from day one without comment.

The new revelations also show the primary reason for the write down was HP’s inability to deliver on recklessly optimistic synergies and its inability to deliver those, not accounting issues at Autonomy.

By using partial leaks, HP continues to try to duck these issues and avoid the errors of its mismanagement and the errors of its 20th November statement coming to light.

The full court filing can be found at:

http://www.scribd.com/doc/239402516/Addendum-to-HP-court-filing-09-04-2014

[1] Leo Apotheker at the Deutsche Bank Technology Conference on 13th September 2011: “Autonomy will be, on day one, accretive to HP. For FY 2012, Autonomy, once we integrate it, is accretive to HP…… Now, we have identified five synergy possibilities– five synergy leverages on how we can build up the Autonomy business and how we can synergize it between HP and Autonomy.”

[2] Bloomberg: “HP’s Accounting Claims are Seen as Cover for Bad Deals” 21 November 2012

[3] Bloomberg: “HP Plunges on $8.8 Billion Charge From Autonomy Write down” 20 November 2012

[4] Reuters: “HP alleges Autonomy wrongdoing, takes $8.8 billion charge” 20 November 2012

[5] Hewlett-Packard Q4 2012 Earnings Call

[6] AllThingsD: “What Exactly Happened at Autonomy” 20 November 2012